Financial PR: Your Complete Step-By-Step Guide [2025 Update]

When markets wobble, your PR strategy must stand firm.

Financial markets are unpredictable. A single tweet or quarterly earnings miss can wipe billions off a company’s value. The current volatile global economic realities make this more of a dire situation than any time in the last 100 years.

It’s dramatic, yes, but very real, and in these high-stakes moments, public perception matters just as much as performance.

Enter financial PR.

If you’ve ever wondered how companies in the financial services sector manage to sound calm, confident, and completely in control during chaos, you’re about to find out.

In this article, we’ll break down what financial public relations is, why it’s essential, how it’s different from traditional PR, and how tools like Prezly can simplify your life when the stakes are sky-high.

And we promise to make it only a little dramatic.

Financial PR is a specialized arm of public relations focused on managing the reputation and communication efforts of companies in the financial industry. This includes banks, fintechs, investment firms, insurance providers, and publicly traded companies.

Where traditional PR might be all about product launches and lifestyle pitches, financial PR speaks the language of investors, regulators, and analysts.

The stakes are higher, the audiences are sharper, and the room for error is slim. No pressure.

Here’s what it typically involves:

- Investor relations: From earnings reports to shareholder updates, investor relations is about transparency and trust

- Crisis management: When something goes wrong (and it will, I promise!), financial PR steps in to steady the ship

- Regulatory communication: Messaging must meet legal standards and compliance frameworks. Think SEC, FCA, or other regulatory bodies, depending on your location

- Media relations: Building relationships with financial journalists and analysts to get your story told the right way

Money is emotional. That’s why clear and trustworthy communication is everything in finance. Good financial PR doesn’t just make your company look good; it protects your credibility and builds long-term confidence.

Here’s why it counts:

- Trust is everything: Investors and customers alike want to feel safe. Financial PR helps you build that trust through consistent, transparent, and well-timed communication

- Crises don’t wait: Whether it’s a data breach or an earnings miss, financial PR is your front line. A well-crafted statement and fast response can contain the damage

- Investors pay attention to communication: They’re not just analyzing your numbers. They’re reading between the lines of your press releases and executive interviews. Financial PR ensures your messaging reflects competence and vision

- Your reputation is your brand: Positioning your company as a leader in the market isn’t just about performance. It’s also about perception. Financial PR helps you own your narrative

Sure, PR is PR. But financial PR has its own rulebook. If traditional PR is a casual business lunch, financial PR is a regulatory hearing. With cameras.

The key differences:

- More rules, fewer second chances: Financial communication is regulated to protect investors and ensure market fairness. A misstep can lead to legal trouble or a loss of trust.

- Complexity, simplified: You need to translate financial data and jargon into language that key stakeholders (and sometimes the public) can actually understand.

- Tighter timelines: Market-moving news doesn’t wait. Financial PR teams are always ready for rapid response scenarios.

- Scrutiny from all sides: Investors, analysts, journalists, regulators, and even bots are watching. Every word counts.

Example: Think of a company announcing layoffs. Regular PR might focus on company culture and next steps. Financial PR needs to also communicate how this affects cost structures, future guidance, and investor sentiment. And it needs to be done in a tone that’s both empathetic and investor-safe.

Let’s break down the technical-speak mambo jumbo of what actually goes into a solid financial PR strategy:

- Communicates the company’s financial health, plans, and performance

- Handles earnings calls, financial releases, and shareholder engagement

- Often overlaps with corporate finance and legal teams (see also, corporate PR)

- Prepares for potential blowups, like fraud, cybersecurity incidents, or missed forecasts

- Develops response plans that are fast, accurate, and reputationally protective

- Engages with media and stakeholders during high-pressure events

Or, what to do with all those lemons.

- Ensures public statements comply with laws and financial disclosure rules

- Coordinates with legal teams to avoid noncompliance

- Uses disclaimers, risk statements, and boilerplate content consistently (Prezly’s Snippets feature is great for this, hint hint)

- Builds relationships with finance-specific reporters and outlets

- Places stories that frame your company as credible, innovative, or newsworthy

- Navigates embargoes, exclusives, and market timing

Let’s say you’ve got an earnings report, funding round, or policy change to share. Here’s how to get the message out like a pro.

Not all journalists will care about your update, and that’s okay. The goal is to reach the ones who do by building a targeted media list.

Use tools like LinkedIn, SparkToro, and Hunter.io to identify journalists who cover your specific beat, whether that’s fintech, asset management, banking, or crypto.

Check bylines in outlets your audience reads: Financial Times, Bloomberg, TechCrunch, etc.

Look at recent articles to make sure the journalist is still covering relevant topics. A cold pitch about your Series B will flop if it lands in the inbox of someone now writing about climate policy.

Pro tip: Organize your list by topic, location, and outlet tier. With a tool like Prezly, you can tag contacts, track past interactions, and avoid the dreaded “who did we pitch last quarter?” moment.

This is where many financial services brands trip up. Yes, you’re working with technical, highly regulated information, but that doesn’t mean it needs to read like a legal memo.

A strong financial press release should start with a sharp, informative press release headline. Avoid hype. Be specific. Lead with the key takeaway. Are profits up? Did you close a $10M round? Get to the point fast. Finance people hate their time being wasted.

Be sure to include relevant data points and quotes from leadership, ideally with forward-looking statements that show momentum. Use accurate terminology and double-check any forward-looking language with legal or IR teams.

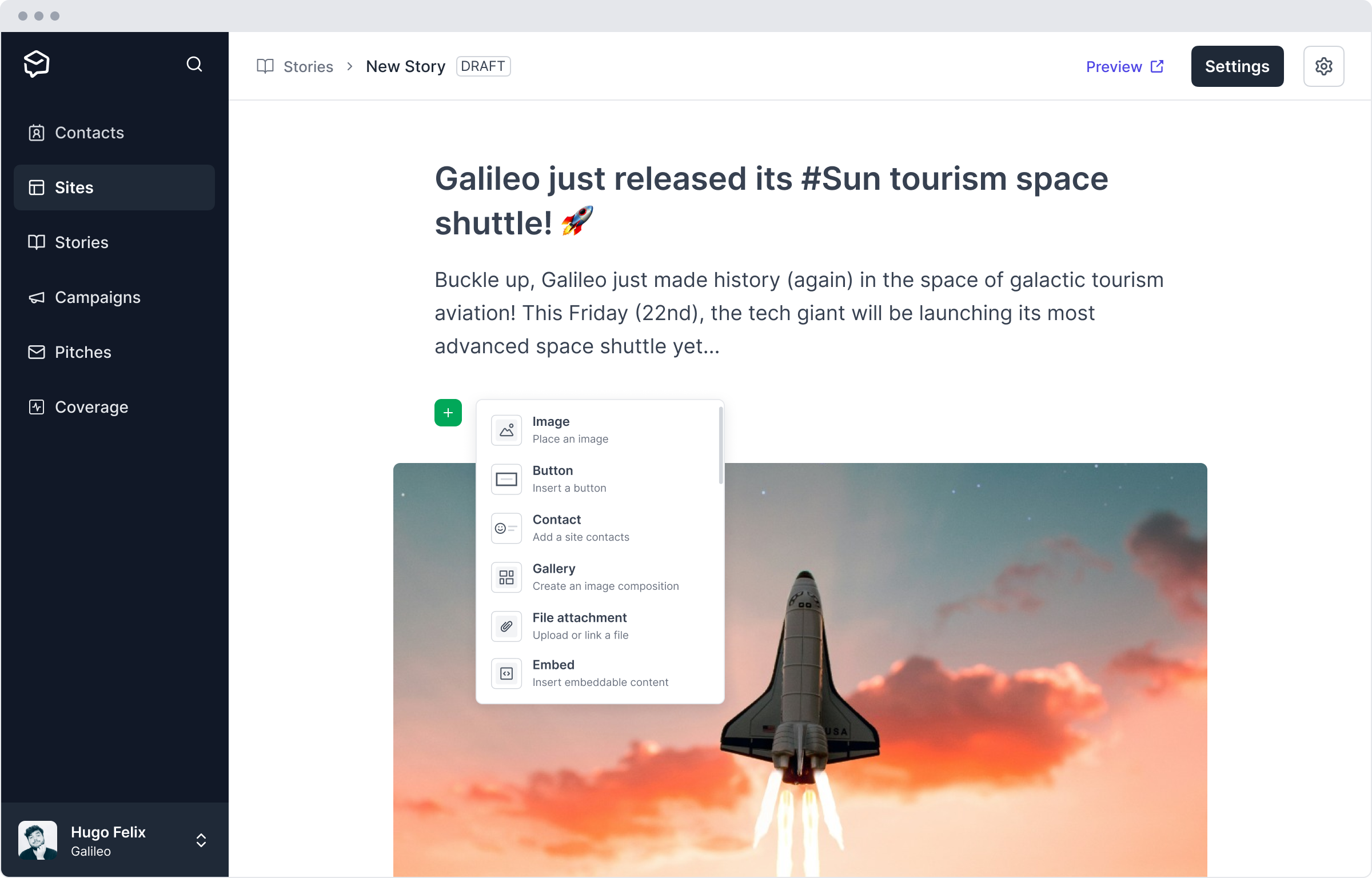

If you’re using Prezly, writing and formatting your release becomes much easier.

You can:

- Add charts, downloadable investor decks, and logos to make your release feel polished

- Create versions of your release for different audiences (like media vs investors)

- Use "snippets" to insert disclaimers, footnotes, or compliance language you use often. No more hunting through old docs to copy and paste

.jpg)

Step-by-step advice on what to include in your press release, learned from 200+ of the industry's best examples.

Sending your release is only half the job. Now you need to see what happens next.

Monitoring tools help you:

- Track who picked up your story and where it appeared

- Analyze tone and sentiment across media and social platforms

- Spot emerging trends in how your brand or competitors are being covered

For financial services clients, especially those navigating financial uncertainty, real-time feedback is essential. Whether you're in asset management, brokerage, or wealth management, knowing how your message landed with key audiences helps you refine your approach.

Prezly's media monitoring mean you don’t have to jump between platforms, whether you're pitching a story, compiling a press release, or updating your newsroom. You’ll get real-time alerts and a clear overview of what’s working, and what needs a follow-up.

Bonus tip: Keep track of which relevant journalists covered your story and how they framed it. This intelligence feeds future PR campaigns, helping you tailor each pitch to the right contact and increase engagement levels.

Don’t leave your great press release to die in someone’s inbox. Give it a second life in a public, always-up-to-date newsroom.

In the financial services sector, where information needs to be accurate, current, and easily accessible, a newsroom is more than just a nice-to-have – it's one of the core building blocks of a professional PR strategy.

A financial newsroom is:

- A branded hub for your media content, from press releases to quarterly updates, investor presentations, leadership bios, and contact info

- Easy for journalists to browse and reference

- A powerful signal of strategic communication, transparency, and forward-thinking

With Prezly, you can launch a newsroom that fits your brand’s look and feel without needing a dev team. It’s searchable, multimedia-friendly, and accessible, meaning journalists and investors can always find the information they need without chasing someone down.

Plus, if you’re working with a distributed team or agency partners, everyone can access the same source of truth without having to dig through Outlook for a bunch of cluttery PDFs.

Sometimes, doing it yourself is too risky, or just not feasible. Financial PR can be a demanding, high-pressure function, especially if your internal team is juggling multiple responsibilities or lacks deep regulatory knowledge. That’s when bringing in a dedicated financial PR agency can be a smart investment.

Agencies bring a level of specialization and experience that can make all the difference in both day-to-day comms and high-stakes situations. They know how to navigate the legal landscape, simplify complex financial messaging, and build media relationships that would otherwise take years to establish.

Here’s when to call in the experts.

Whether you’re going through a merger, acquisition, executive shake-up, data breach, or large-scale layoffs, these moments demand fast, strategic communication. Every minute counts, and mistakes can be costly. Not just in fines, but in lost trust and market confidence.

A seasoned financial PR agency knows how to respond swiftly, shape the narrative, and reassure stakeholders without overpromising or exposing your brand to additional risk.

They’ll help you:

- Draft holding statements and Q&As within minutes

- Coordinate across legal and compliance teams

- Manage inbound media inquiries calmly and clearly

- Monitor sentiment in real time and adjust messaging as needed

Not every in-house comms team has a financial specialist on hand. And even if they do, the demands of regulatory language, investor sentiment, and media timing can stretch even the most experienced generalist. Agencies that specialize in financial public relations bring that depth of knowledge to the table.

They’re fluent in:

- Financial reporting cycles and disclosure obligations

- Regulatory standards like SEC filings or FCA regulations

- Investor expectations and stakeholder psychology

- Pitching financial stories without sounding like a spreadsheet

Relationships matter. A lot. Financial PR agencies often have longstanding connections with finance editors, beat reporters, and market commentators. These contacts can be the difference between your story getting buried or landing a spot in a major outlet.

An agency can:

- Pitch your story directly to the right journalists

- Arrange interviews with executives that build thought leadership

- Navigate embargoes and exclusives to give your news a strategic edge

- Keep your company top-of-mind with key media even when you’re not announcing anything

PR isn’t just about what you say. It’s about when, where, and how you say it. A good financial PR agency will make sure your communication efforts align with your business goals, market strategy, and overall brand voice.

That might include:

- Refining your investor messaging ahead of a funding round or IPO

- Developing a long-term narrative that showcases innovation or growth

- Positioning your brand as a market leader through strategic thought pieces or op-eds

- Helping your leadership team become more visible and credible in the financial press

Are you a PR agency? Use Prezly to collaborate on key messaging, manage permissions, and get an overview of PR work with each client and take the pain out of reporting. See our dedicated agency pricing for the best deals →

Financial PR is about clarity, trust, and compliance. It differs from general PR in its focus, tone, and audience – because when money is involved, mistakes are expensive.

Here’s the bottom line:

- Financial PR is essential for investor relations, crisis management, and regulatory compliance

- A strong financial PR strategy involves a mix of tools, expertise, and planning to engage key audiences

- Financial PR services are especially valuable when navigating major transitions or ensuring message accuracy in regulated environments

- Whether you're working in asset management, brokerage firms, wealth management, or other financial services, a thoughtful PR strategy can protect your reputation and build long-term credibility

- Tools like Prezly streamline press release creation, media monitoring, and newsroom management

Try Prezly free for 14 days and see how it simplifies financial communications, from investor updates to newsroom publishing.